Fabulous Info About How To Maintain Credit Score

Aside from keeping your accounts open, especially those showing a long history, and making your payments on time, there are other good practices you need to observe to.

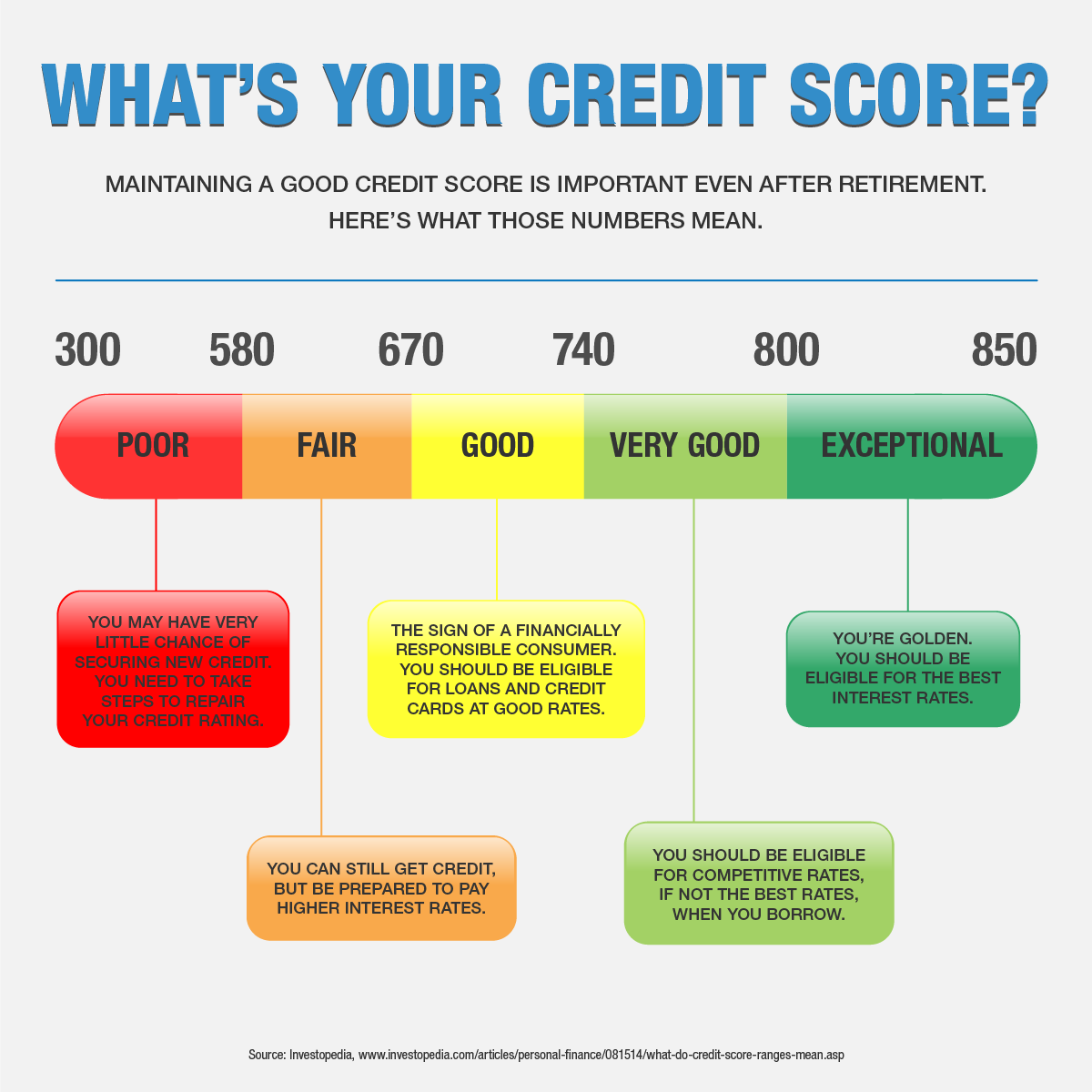

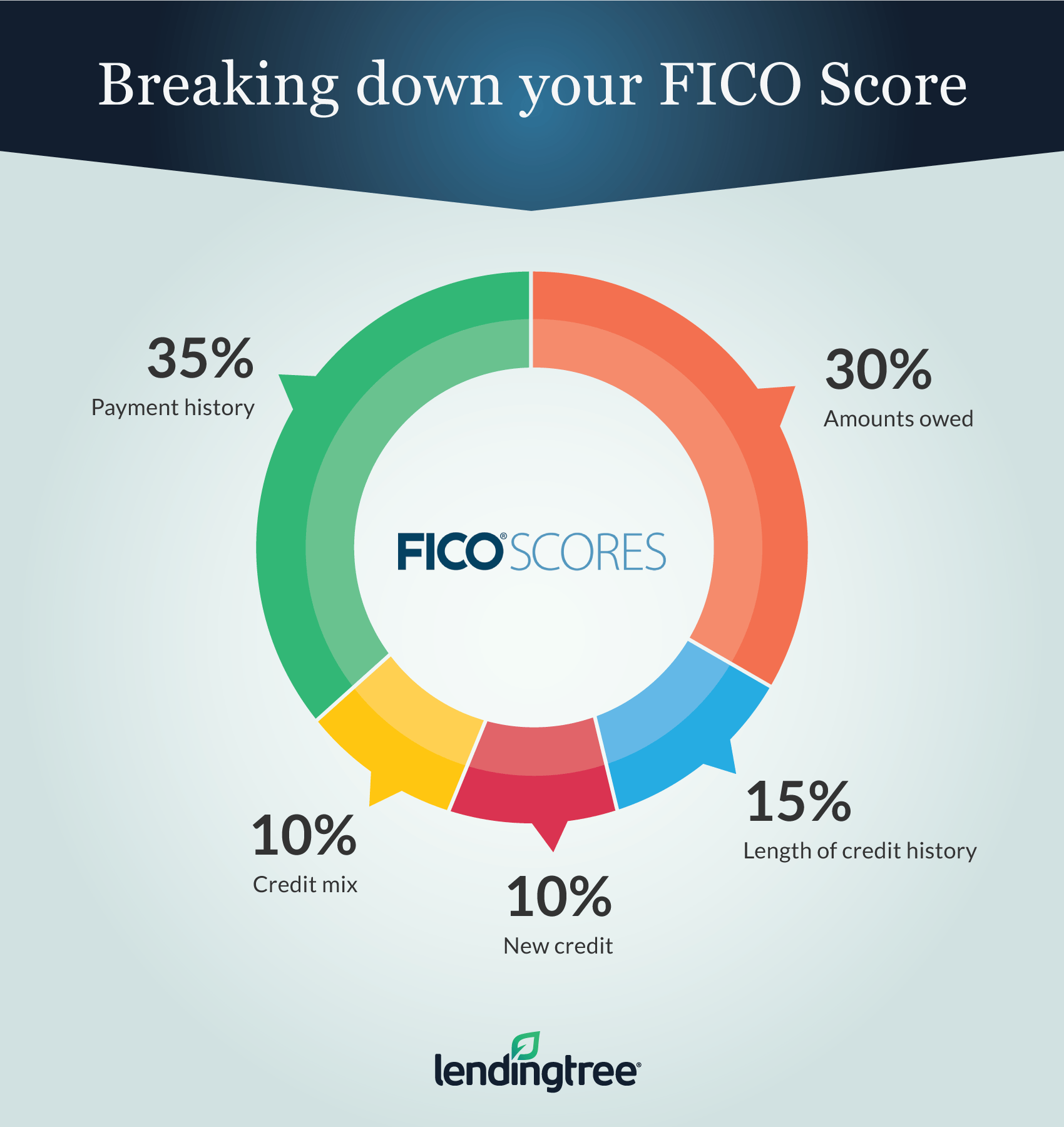

How to maintain credit score. Utilising your credit wisely will help you maintain a high credit score and keep access to the best rates and terms on loans. Although a 30% or less credit utilization rate is the goal, it will be. 9 tips for maintaining a good credit score 1.

Point it in the right direction with creditcompass™! Ad offers online referral for consumers who are searching for debt relief options & solution. Ad learn 7 actionable tips to help rebuild your credit and improve your score.

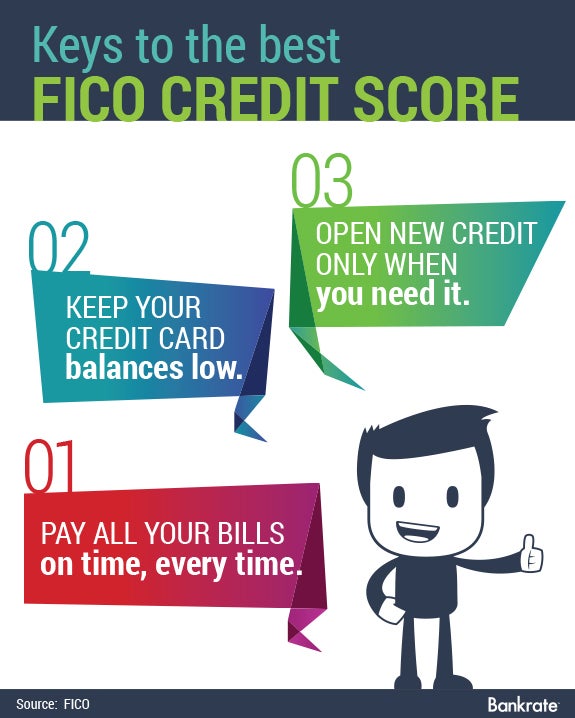

The first thing you should do if you want to build credit at 19 is establish healthy finances. Learn more about ways to help you rebuild your credit score. Keep credit card balances as low as possible.

Experts say that you should try to stay below 30 percent of your credit limit. So if you can spend a maximum of $100 on your credit card (your credit limit), that means you shouldn’t have a. Don’t close out paid off credit.

Pay bills in full and on time. So, if you have a $1,000 credit limit, you should keep your balance below $300. Late payments can snowball and create worse problems for your credit score and financial health.

This is the most important thing you can do to maintain your credit score. It’s best to keep your credit utilization ratio below 30%. A low balance promotes healthy spending habits and fortifies.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)